Cryptocurrency has evolved from a niche technological experiment to a global financial asset class. With growing institutional interest, increasing adoption, and rapidly maturing infrastructure, it has become a valid investment option for both individuals and institutions.

Long-Term Growth Potential

Cryptocurrency markets have demonstrated significant growth over the past decade. Bitcoin, for example, has appreciated from a few cents in 2009 to tens of thousands of dollars today. Ethereum and other altcoins have also shown exponential value increases.

- Market Cap Expansion: The total cryptocurrency market capitalization has grown from under $20 billion in 2016 to over $2 trillion at its peak.

- Technological Evolution: Continuous innovation in blockchain technology supports sustainable long-term utility and valuation.

Portfolio Diversification

10 Reasons Why You Should Invest in Cryptocurrency provide a non-correlated asset class, which helps reduce overall portfolio risk. One of the most compelling reasons to consider cryptocurrency as an investment is its ability to enhance portfolio diversification. In finance, diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The goal is to minimize the impact of poor performance in any one asset class. Cryptocurrencies offer a unique opportunity to achieve this.

- Low Correlation to Traditional Assets: Bitcoin, in particular, often moves independently of stocks and bonds.

- Risk Spreading: Diversifying into crypto can provide a hedge against volatility in traditional markets.

Inflation Resistance

Cryptocurrencies like Bitcoin are often seen as digital alternatives to gold. Inflation is the gradual decrease in purchasing power of a currency, often caused by excessive money printing and economic instability. Over time, inflation erodes the real value of traditional savings and income. One of the key reasons investors are turning to cryptocurrency is its potential to resist inflation especially compared to fiat currencies like the U.S. dollar, euro, or others.

- Fixed Supply: Bitcoin has a capped supply of 21 million coins, making it immune to inflation caused by excessive monetary printing.

- Decentralized Monetary Policy: Unlike fiat currencies, most cryptocurrencies have transparent, rule-based issuance schedules.

Is cryptocurrency a good investment

Is cryptocurrency a good investment? Well, the answer isn’t a simple yes or no it really depends on your goals, risk tolerance, and understanding of the market. Here’s a quick breakdown to help you decide if crypto might be a good fit for you.

- High Growth Potential: Cryptocurrencies like Bitcoin and Ethereum have shown incredible growth over the past decade. Early investors saw massive returns that outperformed many traditional assets.

- Diversification: Crypto offers a new asset class that isn’t directly tied to stocks or bonds, helping diversify your portfolio and reduce overall risk.

- Innovation and Adoption: Blockchain technology is evolving fast, with more companies, institutions, and governments exploring crypto. This increasing adoption could drive further growth.

- Accessibility: You can start investing with very small amounts and trade anytime, making it easy for new investors to participate.

Decentralization and Ownership

One of the most significant advantages of cryptocurrencies is user autonomy. One of the most powerful and revolutionary features of cryptocurrency is decentralization. Traditional financial systems are controlled by central authorities such as banks, governments, or financial institutions. In contrast, cryptocurrencies operate on decentralized networks, offering users a higher degree of personal ownership and financial freedom.

- Peer-to-Peer Transfers: Transactions occur directly between users without intermediaries.

- Control Over Funds: Private wallets allow full ownership, avoiding reliance on centralized institutions.

Read Also: Understanding Car Terms From Drivetrain to Dashboard Lights

What Does Decentralization Mean?

Decentralization in cryptocurrency refers to the distribution of control across a network of nodes (computers) rather than a single central authority. Instead of relying on a central bank or payment processor, cryptocurrencies use blockchain technology to validate and record transactions.

- Every transaction is confirmed and stored on a public ledger by participants (miners or validators), ensuring transparency and reducing the risk of fraud or manipulation.

- No single entity can alter transaction data, freeze accounts, or reverse payments arbitrarily.

Is cryptocurrency safe

Cryptocurrencies like Bitcoin and Ethereum are built on blockchain technology, which is designed to be secure, transparent, and tamper-resistant. Transactions are recorded on a decentralized ledger that’s very hard to hack or alter. So, from a technical standpoint, the blockchain networks themselves are generally very safe.

Exchanges Can Be Vulnerable: Many people buy and store crypto on exchanges. However, exchanges can be hacked or experience outages, which can put your funds at risk if they don’t have strong security measures.

Wallet Security: If you hold your own crypto in a digital wallet, it’s only as safe as your private keys. Losing your keys or sharing them with someone else can mean losing access to your coins forever.

Scams and Fraud: The crypto space has attracted scammers who try to trick people with fake ICOs, phishing attacks, or Ponzi schemes. Staying vigilant and doing thorough research is crucial.

User Errors: Unlike banks, there’s no “forgot password” option for crypto wallets. Mistakes like sending coins to the wrong address or losing your recovery phrase can lead to permanent loss.

Accessibility and Financial Inclusion

Cryptocurrencies enable access to financial systems for unbanked and underbanked populations worldwide. One of the most impactful advantages of cryptocurrency is its ability to promote accessibility and financial inclusion on a global scale. Unlike traditional banking systems that often exclude large segments of the population, cryptocurrencies provide open and equal access to financial tools regardless of geography, income level, or social status.

- Low Entry Barriers: Anyone with internet access can participate in crypto markets.

- Reduced Transaction Costs: Especially beneficial in cross-border payments and remittances.

Technological and Financial Innovation

Investing in cryptocurrency supports broader blockchain-based technologies such as:

- Decentralized Finance (DeFi): Financial services like lending, borrowing, and trading without traditional banks.

- Non-Fungible Tokens (NFTs): Ownership of digital art, music, and intellectual property.

- Web3: A decentralized internet emphasizing user control and data privacy.

Increasing Institutional Adoption

Institutional involvement enhances legitimacy and stability in the market. In recent years, one of the strongest signals of cryptocurrency’s staying power has been its growing institutional adoption. No longer just a playground for tech enthusiasts and retail investors, cryptocurrencies are now being embraced by some of the largest and most influential institutions in the world. This shift is adding legitimacy, stability, and long-term potential to the crypto ecosystem.

- Major Players Involved: Tesla, PayPal, BlackRock, and Fidelity are among the companies engaging with crypto.

- Exchange-Traded Funds (ETFs): Approval of crypto ETFs in multiple countries enables traditional investors to access digital assets.

What Is Institutional Adoption?

Institutional adoption refers to the entry of large organizations such as banks, hedge funds, asset managers, public companies, and governments into the cryptocurrency space. These entities are no longer ignoring digital assets; instead, they’re actively investing in, building around, or integrating cryptocurrency into their operations.

Transparent and Secure Transactions

Cryptocurrency transactions are recorded on blockchain ledgers, ensuring transparency and security.

- Public Audit Trails: Every transaction is verifiable and immutable.

- Cryptographic Security: Transactions are protected by advanced encryption, reducing the risk of fraud.

Continuous Market Operation

Cryptocurrency markets operate 24/7, unlike traditional stock markets. One of the standout advantages of cryptocurrency is its 24/7 market operation. Unlike traditional financial markets—which typically operate during set business hours and close on weekends and holidays—crypto markets never sleep. They’re open 365 days a year, 24 hours a day, allowing for constant trading, investing, and asset management.

- Flexibility for Investors: You can trade at any time, accommodating global time zones and personal schedules.

- Faster Market Reactions: Investors can respond instantly to news and events.

Early Adoption Opportunity

Cryptocurrencies are still in an early adoption phase compared to traditional asset classes. Investing in cryptocurrency today presents a rare and powerful early adoption opportunity. While digital assets have grown significantly since Bitcoin’s debut in 2009, we are still in the early stages of what could be a long-term financial revolution. Getting involved now means you’re positioning yourself ahead of the mainstream curve—much like buying into the internet before Google or social media before Facebook.

- Emerging Asset Class: Adoption is growing, but total global penetration remains relatively low.

- First-Mover Advantage: Entering early allows investors to benefit from broader market growth and technology development.

Risks and Considerations

While the potential benefits of investing in cryptocurrency are substantial, it’s equally important to recognize the risks and challenges that come with it. Like any investment especially one in a fast-evolving and relatively young industry crypto isn’t without its pitfalls. Being aware of these can help you make smarter, more informed decisions.

While the reasons to invest are compelling, investors should also consider:

- Volatility: Prices can fluctuate dramatically in short periods.

- Regulatory Risks: Global regulation of cryptocurrencies is still evolving.

- Security Responsibility: Investors must secure their wallets and private keys.

Proper due diligence, risk assessment, and education are essential before making any investment decision.

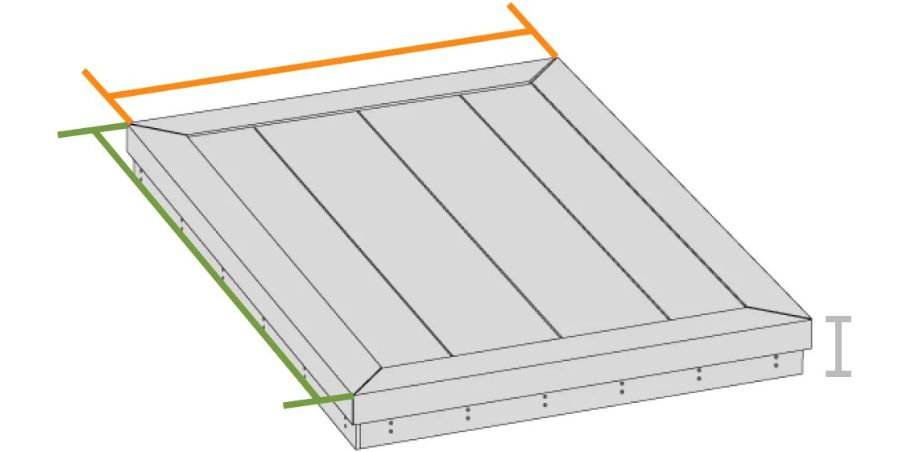

How to Begin Cryptocurrency Investment

Starting your cryptocurrency investment journey can feel overwhelming initially, but with the right steps and a bit of education, it’s easier than you might think. Whether you’re in it for long-term growth, diversification, or curiosity, getting started doesn’t require a fortune or technical expertise. Let’s walk through a simple, practical guide to begin smartly investing in cryptocurrency.

- Educate Yourself: Understand how blockchain works, the different types of cryptocurrencies, and market trends.

- Select a Platform: Use reputable exchanges like Coinbase, Binance, or Kraken.

- Secure Your Assets: Consider using hardware wallets (e.g., Ledger, Trezor) for long-term storage.

- Diversify: Don’t invest solely in one coin; build a balanced portfolio.

FAQs About 10 Reasons Why You Should Invest in Cryptocurrency

What makes cryptocurrency different from traditional money?

Cryptocurrency is decentralized, digital, and operates on blockchain technology, eliminating the need for central banks or intermediaries.

Is investing in cryptocurrency legal?

Yes, in most countries, but regulations vary. Always check local laws before investing.

Which cryptocurrencies are best for beginners?

Bitcoin and Ethereum are generally considered the most stable and beginner-friendly options.

How much should I invest in crypto?

Only invest what you can afford to lose. Experts suggest starting with a small percentage of your total investment portfolio.

Can cryptocurrency replace traditional financial systems?

Not entirely, but it can complement or disrupt certain functions like payments, lending, and international transfers.

Conclusion

10 Reasons Why You Should Invest in Cryptocurrency offers both opportunity and complexity. From long-term growth and financial inclusivity to technological advancement and decentralization, the benefits are numerous. However, potential investors should carefully weigh the risks and educate themselves before participating. As the ecosystem continues to evolve, cryptocurrency is poised to become a significant component of the global financial landscape.

Latest Post!

- What are the main factors influencing ICICI Bank’s price movement?

- Master Your Deck Project: How to Use a Deck Calculator Without Costly Mistakes

- How Electric Golf Carts Are Revolutionizing Golf and Community Living

- Google Colab GPU: A Complete Guide to Free Cloud-Based GPU Computing

- Why Vazhazasqim Is the Powerful Mental Shift You Need Today

- Mirabake: Redefining Kitchen Efficiency Through Innovation